Welcome to State of play, a series where we gather insight on the world's most pressing issues. In our first edition, we explore the carbon credits industry and invited Sylvera - the carbon credits rating agency, to provide their insight into the 'state of play' for the carbon credits industry.

'Carbon credits' are purchased to offset corporations' and individuals' carbon emissions and are a crucial tool in the world's drive towards net-zero. The increase in demand for carbon credits has led to increased scrutiny of the quality of the credits. It is often very unclear what buyers are actually buying. There's no doubt we need improved transparency and clarity around carbon credits, but how close are we to achieving this?

Here, we catch up with Sylvera to discuss the topic of carbon credits. Sylvera provides in-depth and high-quality carbon ratings, which enable companies to invest in high-quality offsets and help deliver net-zero commitments.

What's your current view of the carbon credits industry?

After emissions reductions, carbon markets are the greatest tool we have to achieve net-zero.

The reason for this is simple. The reality is, today, it is impossible for 100% decarbonisation in most industries. The technology is just not there yet.

So, while this technology comes on stream, carbon markets are a powerful tool for corporations to achieve their net-zero targets.

To be clear, carbon markets are by no means a cure-all solution. For carbon offsetting to be effective, it must be part of an organisation's broader climate action strategy. This must include reducing their own greenhouse gas emissions as a first step before carbon offsetting is explored as a complementary strategy.

However, it is imperative that we reduce greenhouse gas emissions within a specific time frame, and we have no more time to waste. Carbon offsetting allows immediate action, for example, allowing indigenous people and local communities to benefit from forest conservation and associated biodiversity and social co-benefits, rather than being economically incentivised to unsustainably exploiting forest resources. Nature-based solutions also have significant potential to scale: it is estimated that they can provide one-third of the carbon reduction the planet needs to stabilise the climate by 2030.

It's undoubtedly a growing space, what is the size and growth of the carbon credits market?

Voluntary carbon markets are scaling fast, and they have the potential to drive billions of dollars of investment into carbon projects. In fact, it has been predicted that voluntary carbon markets will be worth up to $100 billion by 2030.

There has traditionally been a trust problem, and this has the potential to derail this growth trajectory and slow down the pace of change.

If we can add a layer of transparency and inject more trust into the marketplace, we have the power to turn the tide to hit net-zero and mitigate the worst impacts of climate change.

What possible solutions will help to improve the trust of the industry?

To date, corporate buyers have been hamstrung by asymmetric information. They can't assess whether a ton of CO2 sold to them really means a ton and because they can't assess quality, they can't assess value either - and this can often lead to them overpaying for the credits they purchase.

So, ultimately, the market needs reliable data to establish trust.

This is what we do at Sylvera.

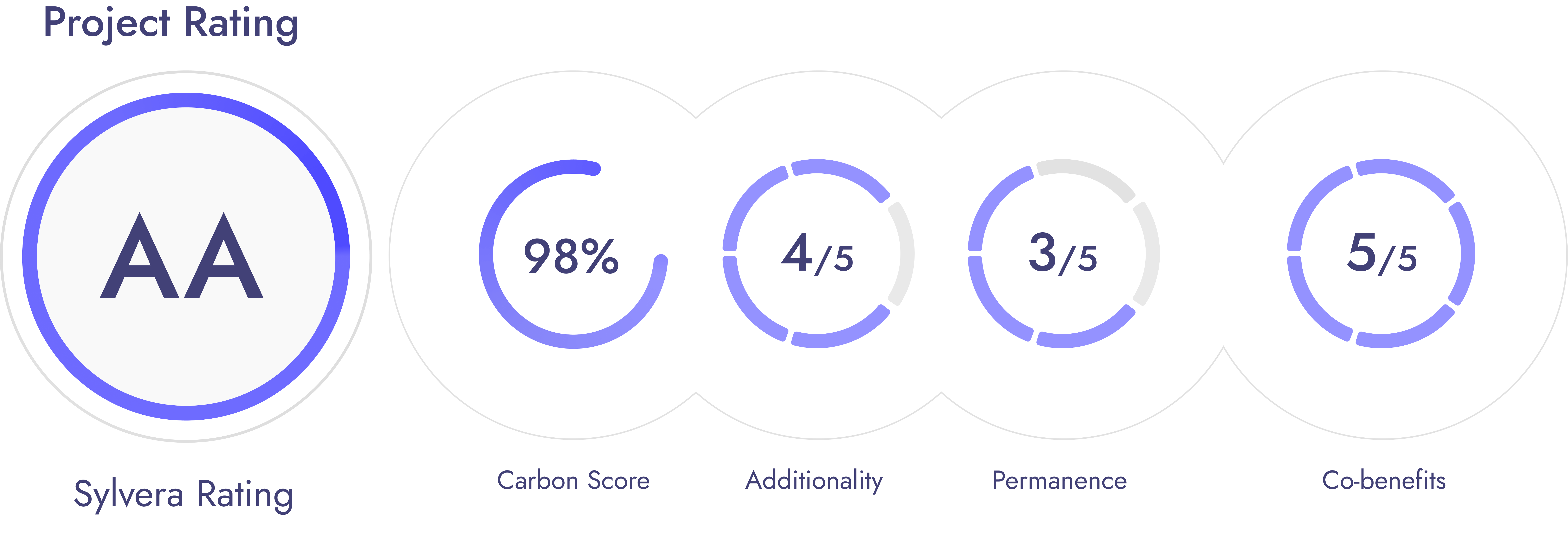

We use cutting-edge technology and expert teams to produce independent, detailed, and accessible ratings that assess offset projects on objective measures of quality. These ratings collapse an insanely complex process down into three fundamental questions:

- Did the project issue the correct number of credits?

- Would the project's activities have occurred anyway and without the revenue from a carbon credit?

- Will the CO2 be out of the atmosphere for a meaningful period of time?

On top of this, we also consider the co-benefits that the project brings to local communities and the environment - particularly biodiversity. By adding this transparency, we can ensure that high-quality projects command the price they deserve, and projects with poor additionality or unreported issues in performance will be discounted.

How close are we to achieving the solution mentioned above?

Our ratings platform is already helping corporate buyers, traders and exchanges confidently evaluate the best, and most impactful carbon credits to invest in.

We have now rated the majority of REDD+ issued credits and in the remainder of 2022 we will expand our coverage significantly, adding new project types like renewables to our platform.

We're at a critical point in securing the future of the planet, and we're closer than ever to a slew of dramatic climatic and ecological tipping points. But, if we can fix the current market failures, we will have a much better chance of avoiding the most serious impacts.

If you could wish for one thing to improve the industry, what would it be?

To date, there has been little to no correlation between price and quality. This means a great quality carbon project might not be commanding the price it deserves for its credits, while, on the other hand, a poor performing project could be selling credits for too much.

Increased transparency into the quality of projects - through ratings platforms such as ours - will naturally improve this, but we also need corporations to recognise that carbon offsetting is not a get-out-of-jail-free card. By only using carbon offsetting as a means to balance the shortfall of net-zero strategies, low-quality credits will not be purchased in the first place, and demand will increase for high-quality projects that are having a positive, tangible impact on the planet.

If you could wish for one thing to stop in the industry, what would it be?

To date, carbon credits have had a bad reputation and they have been likened to indulgences instead of legitimate solutions. There are two strands to this: thinking about offsets in isolation, and the use of poor-quality offsets.

It's important that offsets are part of a broader decarbonisation strategy, for all companies and countries. The concept of the 'mitigation hierarchy' clarifies that reducing one's own emissions should be the priority. Where that is not possible, at least not in full, high-quality offsets can play a crucial role.

The use of poor-quality offsets is another challenge, one which Sylvera was created to tackle, through the provision of rich, independent data. Our data shows that the majority of projects are having positive impacts on the environment. This activity cannot be discounted if we are to achieve net-zero targets.

To find out more about Sylvera, please visit their website here.